Chapter 13 advanced topics and treatments – Embarking on an in-depth exploration of Chapter 13 bankruptcy, this chapter delves into advanced topics and treatments, providing a comprehensive guide for navigating the complexities of this legal framework. With an authoritative tone and engaging narrative, this discussion offers valuable insights into the intricacies of Chapter 13, empowering readers with the knowledge to make informed decisions.

Chapter 13 bankruptcy presents a unique set of challenges and opportunities, and this chapter provides a thorough examination of the various options available to debtors. From understanding non-standard bankruptcy options to navigating the intricacies of Chapter 13 plans, this discussion equips readers with the tools they need to effectively address their financial challenges.

Advanced Topics

In the realm of bankruptcy, non-standard options provide alternatives to the traditional Chapter 7 and Chapter 13 paths. These options are designed to cater to specific circumstances and offer tailored solutions to individuals and businesses facing financial distress.

Non-standard bankruptcy options encompass a range of approaches, including Chapter 11, Chapter 12, and Chapter 9. Each option has its unique characteristics, advantages, and disadvantages.

Chapter 11 Bankruptcy, Chapter 13 advanced topics and treatments

Chapter 11 bankruptcy is often utilized by businesses and individuals with substantial assets and liabilities. It allows for the reorganization of debts, enabling debtors to continue operating while restructuring their financial obligations.

Advantages of Chapter 11 bankruptcy include:

- Flexibility in restructuring debts

- Ability to continue operating the business

- Potential for preserving equity

Disadvantages of Chapter 11 bankruptcy include:

- Complex and time-consuming process

- High legal and administrative costs

- Potential for loss of control of the business

Chapter 12 Bankruptcy

Chapter 12 bankruptcy is specifically designed for family farmers and fishermen. It provides a framework for reorganizing debts and developing a plan to repay creditors over a period of time.

Advantages of Chapter 12 bankruptcy include:

- Tailored to the needs of farmers and fishermen

- Protects homestead and farming equipment

- Allows for continued farming operations

Disadvantages of Chapter 12 bankruptcy include:

- Limited eligibility criteria

- Can be complex and time-consuming

- May not be suitable for all farmers and fishermen

Chapter 9 Bankruptcy

Chapter 9 bankruptcy is reserved for municipalities, such as cities, towns, and counties. It enables these entities to restructure their debts and continue providing essential services to their communities.

Advantages of Chapter 9 bankruptcy include:

- Protects essential municipal services

- Provides a framework for debt restructuring

- Can help municipalities avoid financial collapse

Disadvantages of Chapter 9 bankruptcy include:

- Complex and time-consuming process

- Potential for political and public scrutiny

- May not be suitable for all municipalities

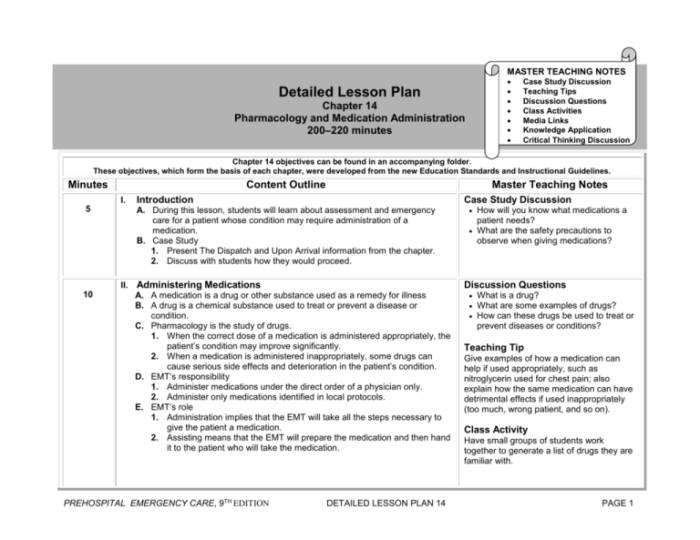

Treatments

Chapter 13 bankruptcy is a form of reorganization bankruptcy that allows individuals to create a plan to repay their debts over a period of time. This plan is tailored to the debtor’s specific financial situation and must be approved by the bankruptcy court.

There are various types of Chapter 13 plans, including:

- Wage earner plans

- Business reorganization plans

- Individual repayment plans

The process of filing a Chapter 13 plan involves the following steps:

- Filing a petition with the bankruptcy court

- Submitting a proposed plan to the court

- Attending a meeting of creditors

- Receiving court approval of the plan

- Making regular payments to creditors according to the plan

To create a feasible Chapter 13 plan, debtors should consider the following factors:

- Income and expenses

- Assets and liabilities

- Debt repayment period

- Interest rates and fees

- Priority of debts

Complex Issues: Chapter 13 Advanced Topics And Treatments

Chapter 13 cases often present complex issues that can challenge debtors and their attorneys. Some common challenges include:

- Income fluctuations

- Unsecured debts

- Tax issues

- Objections to the plan

- Fraudulent transfers

To address and overcome these challenges, debtors and their attorneys can employ various strategies:

- Amending the plan to account for income fluctuations

- Negotiating with creditors to reduce unsecured debts

- Seeking professional tax advice

- Addressing objections to the plan through negotiation or litigation

- Investigating and recovering fraudulent transfers

Case studies or examples can illustrate how these complex issues are resolved in practice:

In one case, a debtor experienced a significant reduction in income after filing for Chapter 13. The debtor’s attorney successfully amended the plan to reduce the monthly payments, allowing the debtor to continue making timely payments and avoid default.

Special Considerations

Chapter 13 bankruptcy can present unique considerations for debtors with high incomes or complex financial situations.

For debtors with high incomes, the bankruptcy court may impose a means test to determine eligibility for Chapter 13. The means test compares the debtor’s income to the median income for their household size and geographic location. If the debtor’s income exceeds the median, they may be ineligible for Chapter 13.

Secured and unsecured debts are treated differently in Chapter 13. Secured debts, such as mortgages and car loans, are typically paid in full through the plan. Unsecured debts, such as credit card debt and medical bills, are paid on a pro rata basis.

This means that creditors receive a percentage of their claims based on the amount of funds available in the plan.

Tax issues can also arise in Chapter 13 bankruptcy. Debtors must continue to file and pay taxes during the bankruptcy process. They may also be able to discharge tax debts through the plan.

User Queries

What are the advantages of filing for Chapter 13 bankruptcy?

Chapter 13 bankruptcy offers several advantages, including the ability to keep non-exempt property, restructure debts into a manageable repayment plan, and potentially discharge remaining debts at the end of the plan period.

What are the eligibility requirements for Chapter 13 bankruptcy?

To be eligible for Chapter 13 bankruptcy, debtors must have regular income and be able to propose a feasible repayment plan that meets the requirements of the Bankruptcy Code.

How long does a Chapter 13 bankruptcy typically last?

The duration of a Chapter 13 bankruptcy plan typically ranges from 3 to 5 years, depending on the debtor’s income and the amount of debt they owe.